Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Real Problems Drive Trucking Growth, Not Vague Ideas

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Owner-Operators Want to Know: The Top Questions Revealed

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

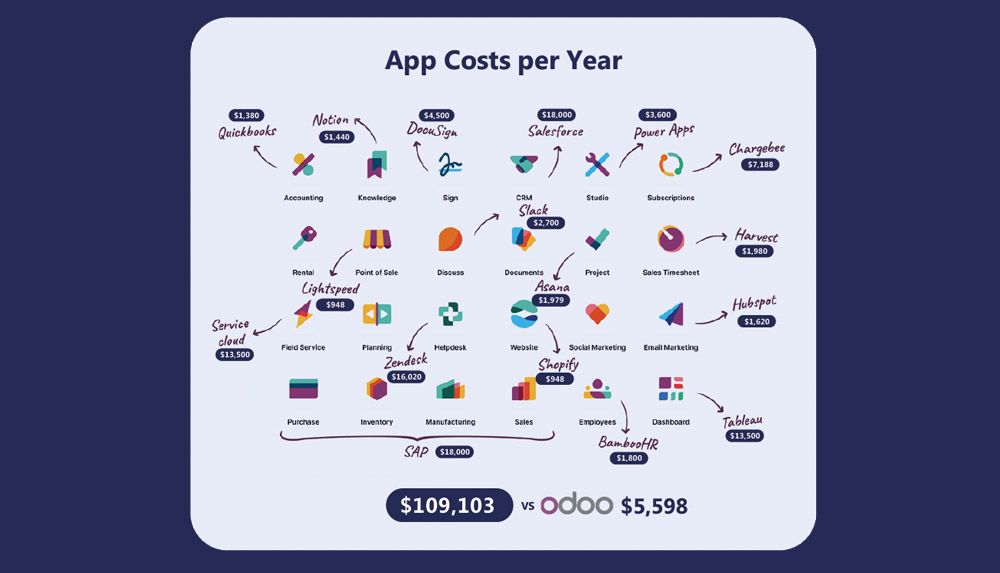

Why Smart Businesses Are Switching to Odoo

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Real Tax Relief: See How M7 Tax Eliminated a $75,000 Penalty for One Client

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

How to Work with U.S. Clients and Pay $0 in U.S. Taxes (Legally)

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Bought Your First Truck? Avoid These 3 Expensive Mistakes

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

How to Cut Business Costs Without Giving Up What Works

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

How do currency fluctuations affect my Cross-Border Tax Obligations?

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

How can I minimize Cross-Border Taxes Legally?

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.