Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Don’t Let Uncle Sam Take Your Wealth: Strategies to Keep More Cash in Your Pocket!

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Maximize Your Refund: Get Those Ducks in a Row Fast for Tax Season 2025!

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Did your tax refund fall short? Maximize Your 2025 Tax Refund: Start Planning Now!

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

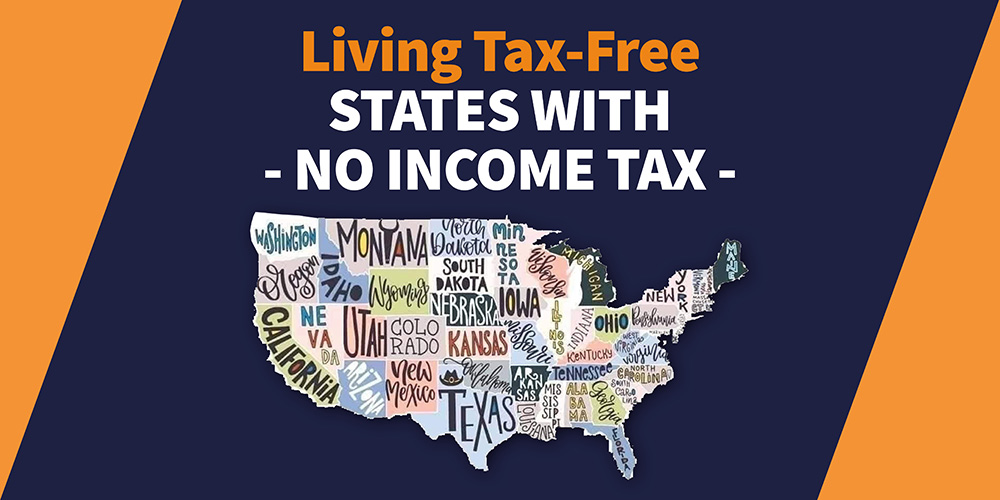

Which States Have No Income Tax?

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Get Ahead of Tax Season 2025: Essential Tips for USA Filers

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Discover the Best Savings That Only a Tax Advisor Can Reveal!

As tax season approaches, many individuals and business owners grapple with a pressing question: “Should I hire a tax advisor?”

The Ultimate Guide to Simplifying Taxes for the Trucking Industry

As an owner-operator truck driver, managing taxes can feel overwhelming. You’re not only running a business but also navigating unique tax rules specific to your industry. Here’s a quick guide to help you stay ahead:

What are the benefits of accounting services for my business?

Looking to expand or streamline operations? Outsourcing accounting services offers numerous advantages, ensuring legal compliance and facilitating business growth, goal achievement, and long-term success.