How to Cut Business Costs Without Giving Up What Works

Are you clear on which expenses are pushing your business forward—and which are slowly eating away at your profits?

Knowing the difference is vital. Business owners need to spot where money is being wasted so they can put it to better use. Some spending decisions are more complex, like offering employee perks or buying higher quality materials. But others are easier to identify, and that’s exactly what we’ll cover here.

We’ve created a practical checklist of 10 areas where you can cut back costs without affecting how your business performs. These ideas are based on over 12 years of experience and work with more than 2,000 small companies. We’ve seen firsthand what makes a difference.

1. Review Your Recurring Credit Card Charges

Start by scanning your business credit card activity. Cancel any tools or subscriptions that are no longer being used. You may also discover you’re paying for two tools that do the same job.

✅ Quick Tip: Set a calendar reminder every three months titled “Subscription Review”

Checklist:

Go through all credit card charges

Remove unused or duplicate tools

Wait for discount offers after canceling

Most providers won’t delete your data, and some might even send special deals to get you back.

2. Use Digital Spending Cards to Stay Within Budget

Instead of tracking spending after it happens, create limits ahead of time with virtual cards. These are available through many banks, or you can use tools like Mercury for easier control.

Steps to follow:

Map out monthly budgets in a spreadsheet

Choose to limit by team member or spending category

Create a card for each person or group

Add spending caps and set up alerts

Share access securely using a password tool

This gives you real control and makes sure money is only spent where needed.

3. Cancel Software Licenses You No Longer Need

Still paying for software assigned to former employees? It’s a common oversight that can cost more than you think.

Check tools like Zoom, Notion, or project platforms for unused seats. Cleaning them up regularly—especially after team changes—can save a lot over time.

4. Compare Internet and Phone Service Options

These services tend to creep up in cost every year. According to U.S. News, prices rose by 14 percent last year alone.

Take time once a year to:

Compare plans and pricing

Explore smaller providers that resell access to major networks

Look into fiber internet or digital phone systems

Set up a backup connection at your location in case one fails

You might save more than you think by switching or simply renegotiating.

5. Delay Vendor Payments Strategically

While it’s great to pay promptly, you shouldn’t pay others faster than you’re getting paid. Doing so turns your business into a free lender.

Adopt Net-30 terms where possible. Keeping cash on hand longer strengthens your position and reduces the need for short-term financing.

6. Stop Running Underperforming Ads

While it’s great to pay promptly, you shouldn’t pay others faster than you’re getting paid. Doing so turns your business into a free lender.

Adopt Net-30 terms where possible. Keeping cash on hand longer strengthens your position and reduces the need for short-term financing.

7. Combine Charges on Your Invoices

Listing every service line by line can cause customers to question the value they’re receiving. If they see too much detail, they may start debating prices.

Try grouping services into single items. This can reduce disputes and streamline both sales and support efforts.

8. Embrace a Paper-Free Workflow

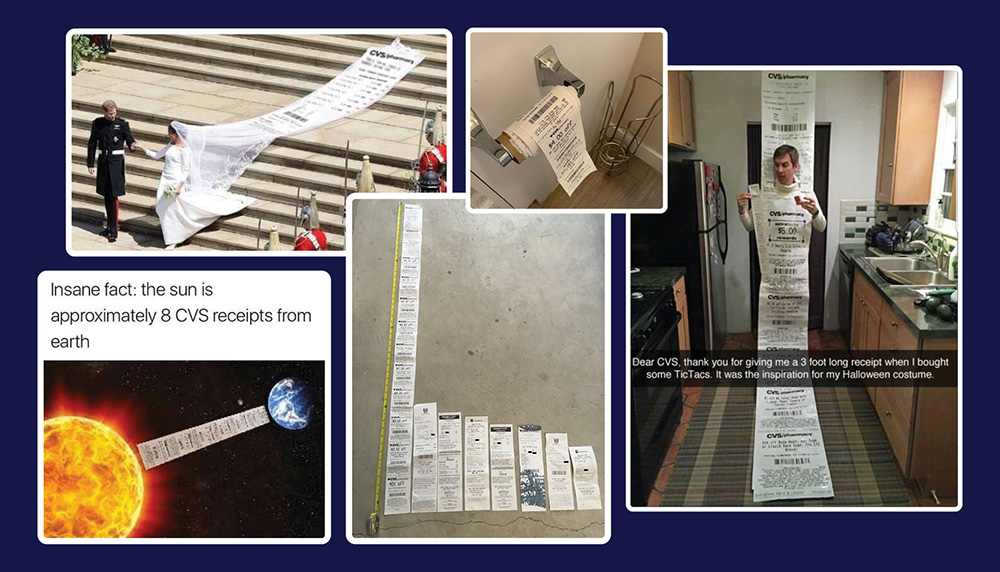

Printing still costs time and money. Most systems now allow receipts and reports to be delivered electronically by default.

CVS reportedly saved fifty million dollars by cutting down on printed receipts. Imagine what even a small percentage of that could mean for your business.

Encourage employees and customers to go digital and place friendly reminders on your documents suggesting not to print unless necessary.

9. Bring in a Bookkeeper

Trying to manage your finances on your own can work at first, but over time it limits growth. A qualified bookkeeper can help you see exactly where your money is going—and where it shouldn’t.

Ask them to customize your financial reports to track the things you care most about, so you always have clarity.

10. Increase Your Credit Limits

This one is easy to overlook but can make a big difference. Log into your credit card accounts and request a higher spending limit.

A larger limit improves your credit profile by reducing your utilization rate. That leads to better financing opportunities and lower borrowing costs.

Requests are usually free and take just a few minutes to complete.

Make This a Yearly Habit

Business expenses naturally rise if you don’t stay on top of them. That’s why we recommend revisiting this checklist every year, especially as part of your annual financial review.

Need help deciding what to cut and what to invest in?

At M7, we support business owners in Mississauga and beyond with tools, systems, and insights that lead to real financial clarity.

📞 Book a free consultation today and get your business on the right track.

📧 Have questions? Reach out at: [email protected]