Expert Personal Tax Services for Hassle-Free Filing

Let a professional handle your taxes,

start to finish every step of the way

Taxes done for you

A tax expert handles the preparation, review, and filing of your taxes—with 100% accuracy and ensures the best possible outcome, delivered on time.

Expertise and background in the tax field

Our tax experts bring over 12 years of professional experience in tax preparation.

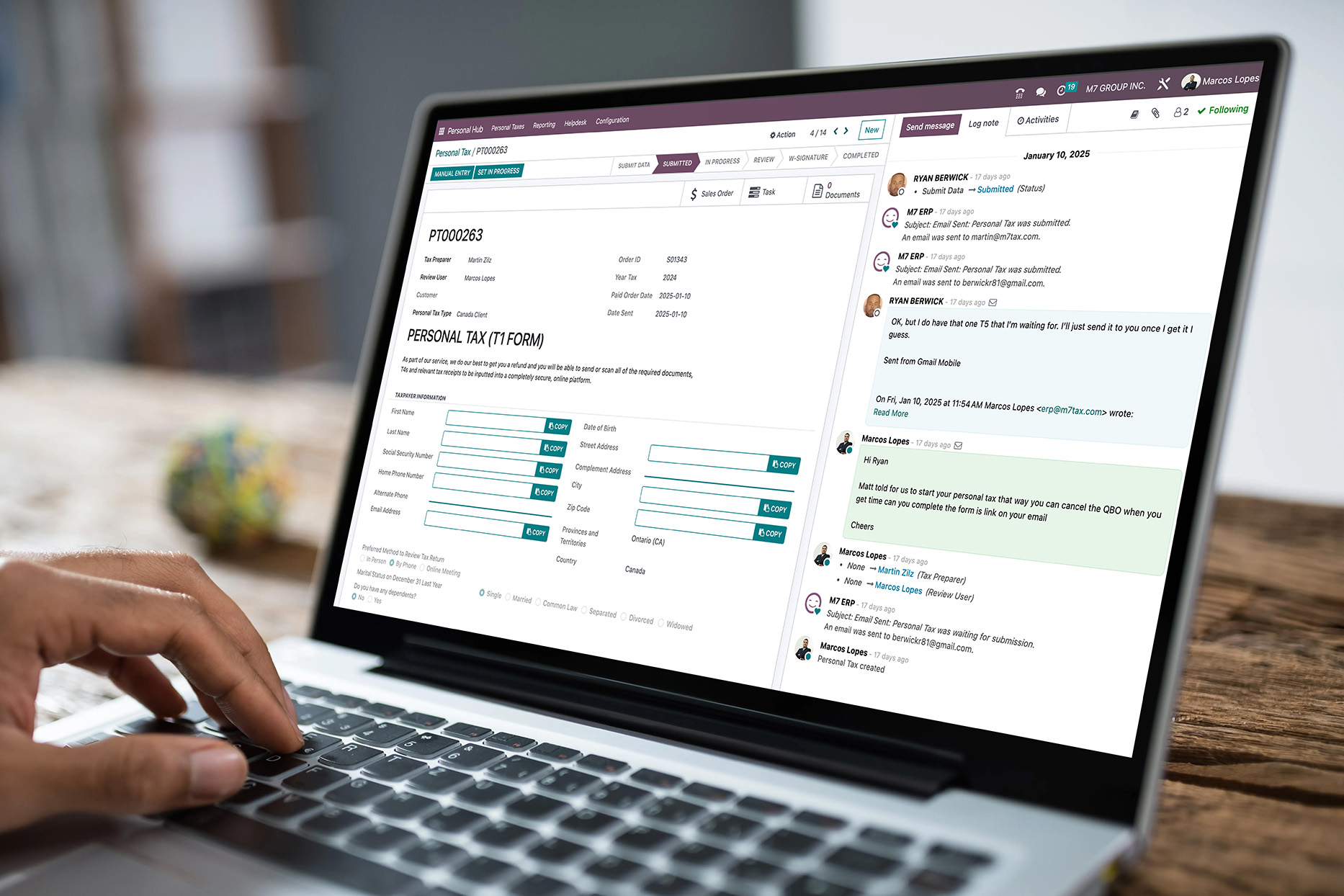

Easy online service

Let an expert handle your taxes online. From March 3 to April 30, we'll be here to help weekdays from 8 AM to 8 PM, and on Saturdays from 9 AM to 3 PM.

Hassle-free tax filing for Self-employed taxes S-Corp taxes C-Corp taxes Partnership taxes

Enjoy peace of mind with lifetime protection for your tax return.

Whether you’re employed, unemployed, married, single, got 5 kids, or work 3 jobs, there’s tax information that fits your situation. Below are some common forms you might include.

This is your wage and tax statement. Employers file a Form W-2 for each employee from whom income, social security, or Medicare tax was withheld.

For non-payroll income including wages for workers who are considered “self-employed”; they own businesses, freelance, take consultancy or gig work, or operate as independent contractors.

Did you pay for college tuition or interest? File a 1098-E if you receive student loan interest of $600 or more from an individual during the year. File 1098-T for reimbursements or refunds of qualified tuition and related expenses.

This form is for reporting stocks and mutual fund income. Yes, that includes if you invested in any “meme stocks” like AMC and GameStop.

+ additional state fee

Best for all business types including S Corp, C Corp, LLC

- Online with an accounting expert

- Dedicated assistance for complex tax situations

- 30 minutes phone/video call to review return

- Included: W-2 job

- Included: Student loans/tuiton

- Included: Dependents

- Included: Retirement income

-

Secured with M7 Tax Audit Protection

1- Receive a Notice. 2- Notify M7 Tax. 3- Tax specialist goes to work (you're covered). 4- The case is resolved.

Step 1:

Set up your account

Answer a few simple questions about your life and work, and authorize us to get your tax slips from the IRS.

Satisfied Clients

Saved in Taxes

Personal Tax Return

Step 2:

Meet your tax expert

Quickly connect with a tax prep expert to review your uploaded documents, and they will ask key questions to help maximize your refund.

Step 3:

They do the work

A dedicated tax expert prepares your return from start to finish, claiming all your credits and deductions, optimizing for the best result.

5,500+ Happy Clients

Don't just take our word for it

Marcos and the M7 team were incredible in helping me with my taxes. It’s the first times I’ve changed accountants in over 10 years and the process was nothing less than exceptional. Fast, efficient, refund provided, great advice given. Marcos even called me to run me through what the team had done for me at the end. I felt extremely confident with them behind me and I would recommend them over and over.

If you're looking for reliable and supportive accounting, I highly recommend M7 Group. Their team was exceptional with my tax refund in the US, providing clear explanations of tax laws. What impressed me the most was their dedication to providing excellent customer service—they were always available and went above and beyond to ensure my satisfaction. Thank you Marcos and Matthew!

Business owners can focus on growth while M7Taxes Inc. handles their financial and accounting needs. Specializing in real-time cash flow insights, M7Taxes helps clients grow and expand, even during challenges like the pandemic. With full compliance, reliable client relationships, and affordable, accurate services, M7Taxes Inc. is committed to supporting business success.