Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

How do currency fluctuations affect my Cross-Border Tax Obligations?

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

How can I minimize Cross-Border Taxes Legally?

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

How to Avoid Double Taxation in Cross-Border Tax

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

The Benefits of Limited Partnerships (LPs) for Non-Residents of Canada

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Is Your Business Running Without Financial Control?

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Don’t Let Uncle Sam Take Your Wealth: Strategies to Keep More Cash in Your Pocket!

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Maximize Your Refund: Get Those Ducks in a Row Fast for Tax Season 2025!

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

Did your tax refund fall short? Maximize Your 2025 Tax Refund: Start Planning Now!

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.

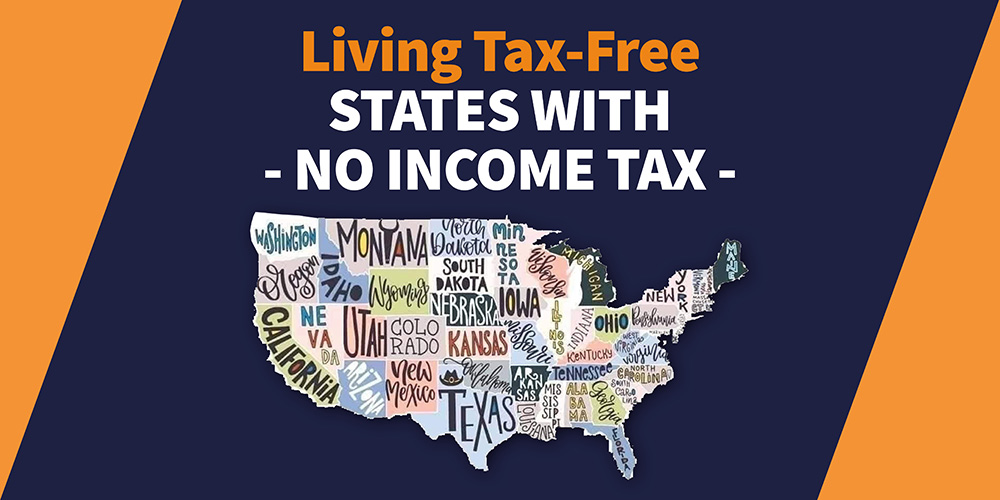

Which States Have No Income Tax?

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing.