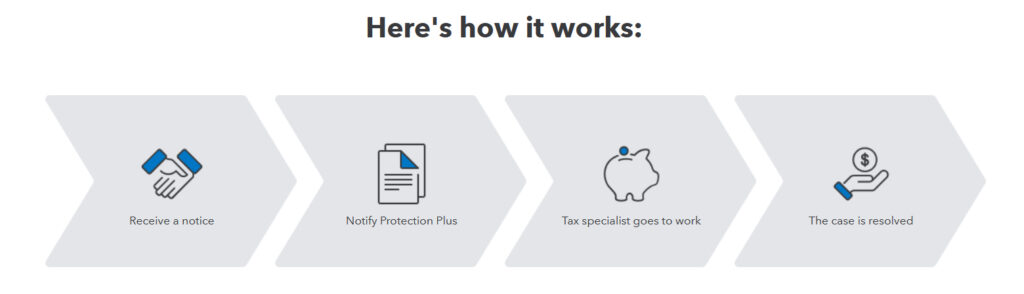

Filing a claim with Protection Plus is simple.

If you get a notice after filing your tax return with us, simply give us a call. We’ll provide up to $1,000,000 in services to resolve your notice through our partnership with Protection Plus. All at no additional cost to you. Get started!

Notices and audit resolution

Our team of experienced EA and CPA case resolution

specialists provide personalized support to help your client:

- Interpret letters from the IRS and the state, and help with correspondence.

- Give guidance on next steps and representation as necessary.

- Research the status of returns with the IRS.

- Reconcile CP2000s and other inquiry letters.

- Address issues with IRS forms including Schedules A, C, and E.

- Assist with denied credits.

- Resolve tax debts and rejected ITINs.