Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing. Click to learn more!

Tax Season 2025 may seem distant, but now is the perfect time to start preparing. Early preparation can help maximize your refund, minimize stress, and ensure you don’t overlook crucial deductions. Here’s a comprehensive guide to get ahead for Tax Season 2025 in the USA.

1. Organize Your Financial Documents

Having all your financial documents in order is essential for a smooth tax season. Begin by gathering the following:

- Income Statements: Collect W-2 forms from your employer, 1099s for freelance work, and any other income sources. Ensure you have a complete record of all income received throughout the year.

- Expense Receipts: Keep meticulous records of business-related expenses, such as travel, office supplies, and utilities. Additionally, don’t forget to gather receipts for charitable donations and medical expenses, as these may be deductible.

- Investment Records: If you have investment income, compile documentation related to stocks, bonds, and other investments to report capital gains or losses accurately.

Pro Tip: Consider implementing a digital record-keeping system. This can streamline the process and reduce the risk of losing important documents.

2. Know Your Deductions and Credits

Understanding which deductions and credits you qualify for is essential:

- Tax Credits: Don’t forget about the Earned Income Tax Credit (EITC) and Child Tax Credit.

- Deductions: Consider potential deductions for education expenses, home office setups, and charitable contributions.

3. Stay Informed on Tax Law Changes

Tax laws can change from year to year, so keep an eye on any new updates for 2025. This may include changes to tax brackets, standard deductions, and credits.

4. Make Estimated Tax Payments

If you’re self-employed, remember to set aside money for estimated quarterly tax payments to avoid penalties.

5. Keep Deadlines in Mind

The standard tax filing deadline in the USA is April 15, 2025. If you need an extension, you can file until October 15, 2025. However, ensure that any taxes owed are paid by the original deadline.

6. Consult a Tax Professional

Working with a tax advisor can help you navigate complex tax laws and ensure you’re taking full advantage of every deduction and credit available to you.

—

Ready to conquer Tax Season 2025?

Reach out to M7 Tax today for expert guidance and personalized strategies designed specifically for you! Don’t let tax season overwhelm you—let us help you navigate it with confidence

Ready to really take control of your tax savings? Download our free eBook now: Tax Secrets Unveiled: Maximize Your Returns and Keep More of What You Earn. In this guide, we reveal insider tips on deductions, write-offs, and strategies that most taxpayers overlook.

Download our eBook, give us a call, and let’s make this tax season the most profitable one yet! And if you need help, don’t hesitate to seek PROFESSIONAL ASSISTANCE to keep your business on the right track.

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

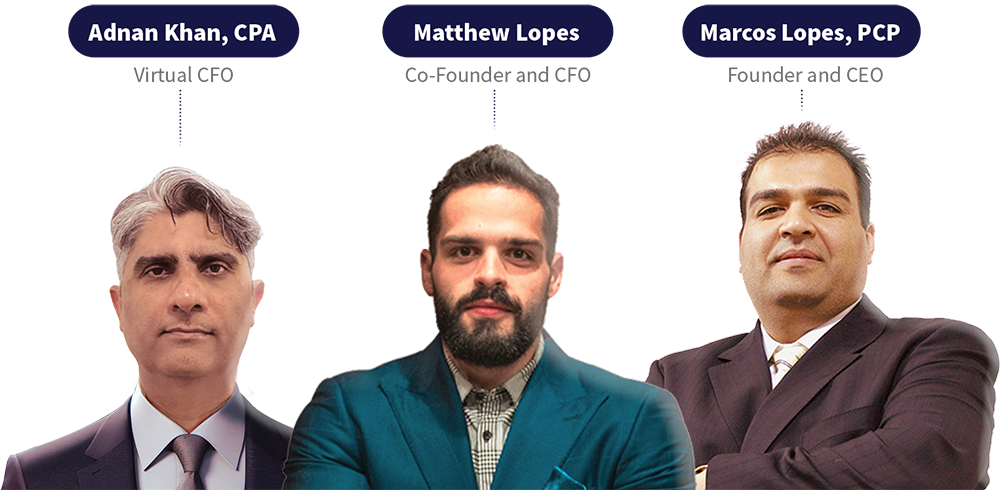

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.

Bookkeeping

Personal & Corporate Tax

Virtual CFO

Business Formation

Financing Solution

Payroll

Software Integration

Consulting

![]()

M7 Figures was established as a consultancy with the goal of creating companies worth seven figures.