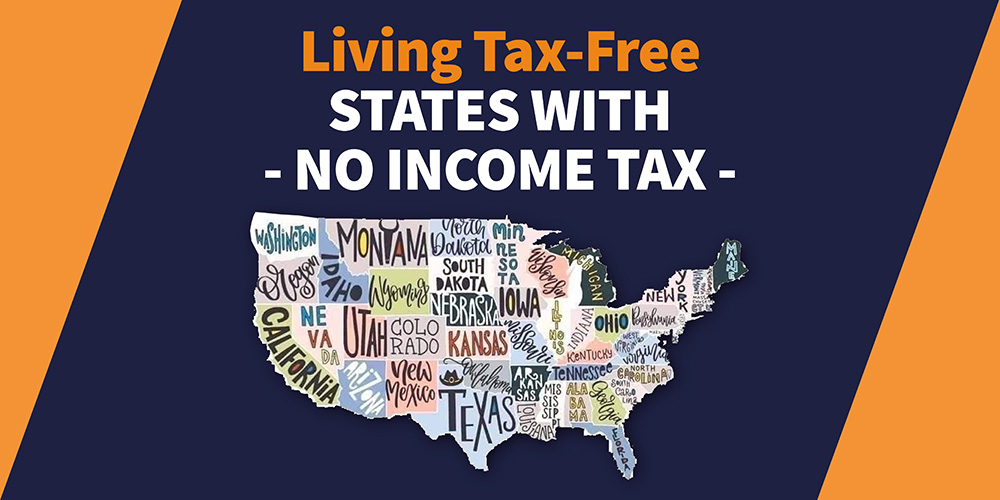

When it comes to personal finance, taxes play a huge role in determining how much of your income you actually get to keep. One key factor in tax planning is where you live. Not all states in the U.S. have the same tax rates, and some states don’t require you to pay state income tax at all! Knowing which states offer this advantage can significantly impact your financial decisions.

If you’re living in one of these states, congratulations—you’re able to keep more of your paycheck! Without state income tax, you don’t have to worry about a percentage of your earnings being taken out, which can translate into big savings over time.

Why No State Income Tax?

Each of these states has its own reasons for not imposing a state income tax. For example, Alaska has a rich oil industry that generates enough revenue to fund state operations, while states like Florida and Nevada rely heavily on tourism to fill their tax coffers. In exchange for no state income tax, many of these states implement other forms of taxation, such as higher sales taxes or property taxes, to balance their budgets.

Exceptions to the Rule

It’s worth noting that while these states don’t tax earned income, some may still tax investment income, such as dividends and interest. For example, Washington and Tennessee currently impose taxes on dividends and interest income, but good news: these taxes are set to phase out by 2025, meaning that soon, these states will also be completely tax-free for all types of income!

The States With the Highest Taxes

On the other side of the spectrum are states with high income taxes. California, New Jersey, and New York are well-known for their high tax rates, with California’s top rate reaching as high as 13.3%. If you’re living in a high-tax state, this can significantly impact your take-home pay, making it more important to take advantage of every tax-saving strategy available.

Optimizing Your Tax Strategy

Where you live can have a big impact on your financial well-being. Relocating to a state with no income tax could allow you to keep more of your earnings, which could make a huge difference over time—especially if you’re self-employed, own a business, or have a high income.

If moving isn’t an option, it’s still essential to optimize your tax strategy within your current state. Whether you live in a tax-free state or one with high taxes, understanding tax deductions and write-offs can also help reduce your tax burden.

If you’re looking for more ways to reduce your taxes, consider downloading our FREE eBook: Optimize Your Taxes. In it, you’ll find tips and strategies on how to maximize your deductions and keep more of your hard-earned money.

In Conclusion

Choosing where to live can have a big impact on your financial future, especially when you factor in taxes. Whether you’re enjoying the benefits of living in a no-income-tax state or trying to optimize your savings in a high-tax state, understanding the rules of the tax game is crucial to maximizing your income.

Need help navigating your state or federal taxes? Download your FREE eBook today to learn more about optimizing your taxes and start saving!

Ready to really take control of your tax savings? Download our free eBook now: Tax Secrets Unveiled: Maximize Your Returns and Keep More of What You Earn. In this guide, we reveal insider tips on deductions, write-offs, and strategies that most taxpayers overlook.

Download our eBook, give us a call, and let’s make this tax season the most profitable one yet! And if you need help, don’t hesitate to seek PROFESSIONAL ASSISTANCE to keep your business on the right track.

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.

Bookkeeping

Personal & Corporate Tax

Virtual CFO

Business Formation

Financing Solution

Payroll

Software Integration

Consulting

![]()

M7 Figures was established as a consultancy with the goal of creating companies worth seven figures.